I still have friends with the perception of applying too

many credit cards will hurt or ruin their Credit scores. They are hesitating to foster

this hobby or goal of “Travel FirstClass For Free”

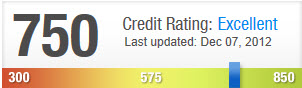

1. My Score

I am still maintaining my Credit Karma score which is a proxy of TransUnion (one of the three credit bureaus) at Excellent level 750, given the fact of

2. I confidently and safely make my statement that applying 20+ cards won’t hurt/ruin your score in a long term, say 6 month to 1 year.

3. However, in short term, it will. Every inquiry (aka hard pull) will likely lower your score by 3~5 points, if you are doing an app-o-rama with 5-7 cards, my experience 20-30 points drop is very likely. By short term, I mean 3-4 months. Therefore, if you are buying a house, car, hold your horse until it’s done.

4. Breakdown of FICO score.

Please have a look at here. Essentially, you can see the 5 factors of different weight really impact your score. My personal experience then:

b. Payment, payment, payment on time, if you can’t, remove all this kind of blogs from your blogroll, you won’t take advantage this hobby at all.

c. Lower your credit utilization, say you have $50,000 in total across the board for all your credit cards, keep the balance at 10-20% level should be safe. Once upon a time, when I don’t have huge credit (now I have over $100,000 J ), I heavily used my credit to 80% level, my score lowered to 640 for a period of time.

d. You can see that once you have more and more credit cards, it’s actually doing good for your score because you have more credit. Does it make sense? That’s explained why those bloggers with 30+ cards and travel around the world for free, their score is still 780.

Recap

1. Applying too many cards wont hurt your credit score in a long run at all, however, you should keep the discipline of paying balance on time and

2. Don’t open too many cards in a short period of time(banks will treat you as aggressive credit seeker and likely shutdown all your cards, not kidding!).

3. Check your credit often and make sure you don’t apply for cards if you have a refinance or mortgage in the coming months.

4. Most importantly, pay the balance on time.

The Answer: No, but it depends.

1. My Score

I am still maintaining my Credit Karma score which is a proxy of TransUnion (one of the three credit bureaus) at Excellent level 750, given the fact of

a. I have/had 20+ credit cards

b. I open/close credit cards every a few months via app-o-rama

c. I had flied 40,000 miles and checked in 30 nights this year, literally paying only tax

d. If I were to convert those benefits into list price of airfare/hotel nights, it would be approx. USD 40~50k (one FirstClass ticket is ~10k USD at least, one suite night is easily beyond $300)

3. However, in short term, it will. Every inquiry (aka hard pull) will likely lower your score by 3~5 points, if you are doing an app-o-rama with 5-7 cards, my experience 20-30 points drop is very likely. By short term, I mean 3-4 months. Therefore, if you are buying a house, car, hold your horse until it’s done.

4. Breakdown of FICO score.

Please have a look at here. Essentially, you can see the 5 factors of different weight really impact your score. My personal experience then:

a. Do not cancel a long history card. If it doesn’t have annually fee, lock in your drawer and make one or two transaction every 6 months. (some banks have policy if you don’t actively use the card every 6 months, they will cancel it). if it comes with fee, talk to your bank to trade(downgrade) to a no-fee card

b. Payment, payment, payment on time, if you can’t, remove all this kind of blogs from your blogroll, you won’t take advantage this hobby at all.

c. Lower your credit utilization, say you have $50,000 in total across the board for all your credit cards, keep the balance at 10-20% level should be safe. Once upon a time, when I don’t have huge credit (now I have over $100,000 J ), I heavily used my credit to 80% level, my score lowered to 640 for a period of time.

d. You can see that once you have more and more credit cards, it’s actually doing good for your score because you have more credit. Does it make sense? That’s explained why those bloggers with 30+ cards and travel around the world for free, their score is still 780.

Recap

1. Applying too many cards wont hurt your credit score in a long run at all, however, you should keep the discipline of paying balance on time and

2. Don’t open too many cards in a short period of time(banks will treat you as aggressive credit seeker and likely shutdown all your cards, not kidding!).

3. Check your credit often and make sure you don’t apply for cards if you have a refinance or mortgage in the coming months.

4. Most importantly, pay the balance on time.

You will distinguish what you owe on your credit reports equal being the types of accounts that they are and their balances, your revolving credit wares and how much you obtain used, what you owe on molecule loans and their embryonic balances and the digit of insignificancy account accounts you obtain. freecreditreportblog.net

ReplyDelete